|Bitumen Africa|

Wednesday, June 26, 2024 11:00

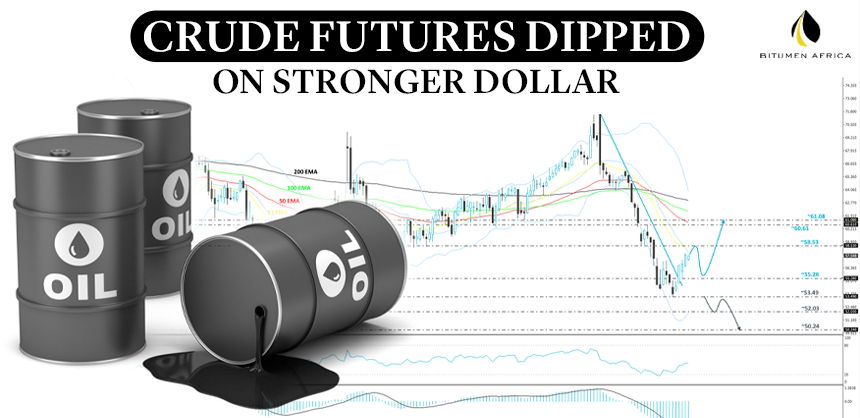

Oil dropped as a stronger dollar and weakness in technical measures overshadowed rising geopolitical risks.

West Texas Intermediate fell to settle below $81, while Brent crude closed around $85 after settling at the highest since late April on Monday.

The US dollar rebounded on Tuesday, making commodities priced in the currency less attractive, and Brent futures have approached overbought territory in recent sessions.

Crude is still holding onto its monthly gain amid renewed global turmoil. Houthi militants have ramped up their attacks on ships off Yemen recently, while Russia has blamed the US as well as Ukraine for a missile strike on occupied Crimea and warned of retaliation.

Implied volatility for Brent has edged higher on the simmering geopolitical risks, including forthcoming elections in Iran, though it still remains near the lowest level in six years.

Analysts at JPMorgan Chase & Co. on Tuesday maintained a forecast that Brent would average $84 a barrel in the third quarter and hit $90 by August or September, “underpinned by our expectations that global demand will outpace supply in the summer quarter.”

Meanwhile, analysts at Macquarie revised their Brent third-quarter forecast up to $86 per barrel, from $83, on projections of rising demand.

Price:

- WTI for August delivery fell 1% to settle at $80.83 a barrel in New York.

- Brent for August settlement fell 1.2% to $85.01 a barrel.

American consumer confidence fell from May to June, and traders will be watching for future measures of inflation and other economic data this week for clues on the path for monetary policy.