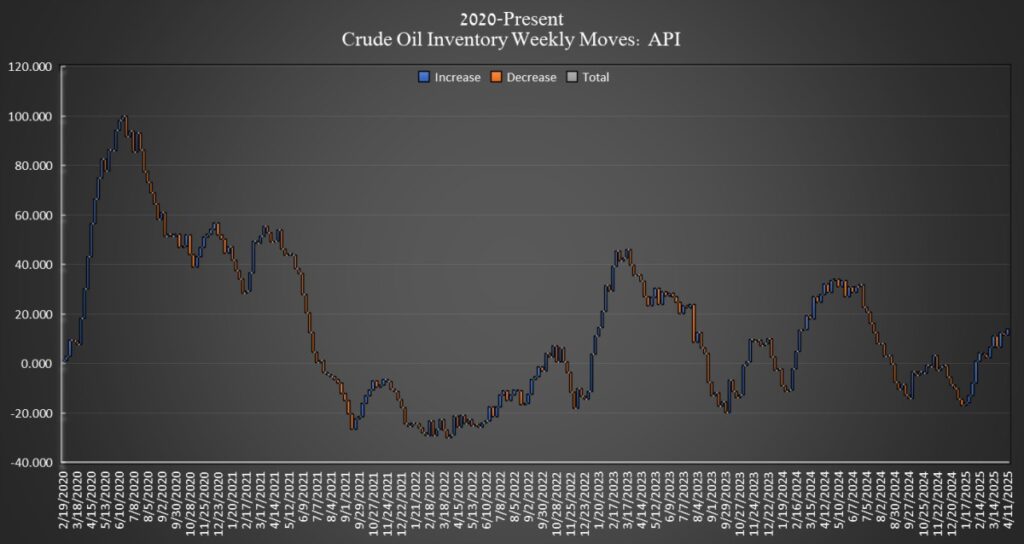

The American Petroleum Institute (API) estimated that crude oil inventories in the United States rose by 2.4 million barrels for the week ending April 11. Analysts expected a loss of 1.680 million for the week. The API estimated a 1.057 million barrel drop in the prior week.

So far this year, crude oil inventories have climbed more than 24 million barrels, according to Oilprice calculations of API data.

Earlier this week, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) climbed 0.3 million barrels again to 397 million barrels in the week ending April 11. Inventory levels in the SPR are hundreds of millions shy of the levels in inventory prior to the SPR withdrawal that took place under the Biden Administration.

At 1:43 pm ET, Brent crude was trading down another $0.32 (-0.49%) on the day, leaving the international benchmark at $64.56. While down on the day, it is a $3 rebound from the lows following the announcement of the Liberation Day tariffs.

WTI was also trading down on the day, by $0.28 (-0.46%) at $61.25—also a $3 per barrel increase over last week’s level.

Gasoline inventories fell in the week ending April 11, by 3 million barrels, after rising by 207,000 barrels in the week prior. As of last week, gasoline inventories are now at the same level as the five-year average for this time of year, according to the latest EIA data.

Distillate inventories fell this week as well, by 3.2 million barrels in the latest week. In the week prior, distillate inventories fell by 1.844 million barrels. Distillate inventories were already about 9% below the five-year average as of the week ending April 4, the latest EIA data shows.

Cushing inventories—the benchmark crude stored and traded at the key delivery point for U.S. futures contracts in Cushing, Oklahoma—rose by 349,000 barrels, the API data showed, after last week’s 636,000 barrel hike.